28+ Mortgage calculator for sale

How a LendingTree Mortgage. Mortgage rates pulled back this week but economic uncertainty continues to keep price-struck buyers at bay.

Job Costing Complete Guide On Job Costing In Detail

Second mortgages come in two main forms home equity loans and home equity lines of credit.

. Typical home price in Texas. The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment. Price Typical single-family home value in 2022.

The total sale price of a property agreed upon between buyer and seller. Id23934 CALL 18778966727. Now that you have your estimated home price check out different loan options with our Mortgage Calculator.

Second mortgage types Lump sum. Almost any data field on this form may be calculated. Personal loans are typically amortized for 25 years.

The lender may also ask for collateral from the person buying the loan. Zillow has 2352 homes for sale. An MMM-Recommended Bonus as of August 2021.

A 100 Percent Mortgage is where a buyer will receive a loan for 100 percent of the propertys value without a down payment. Default claims and properties for sale. In some cases the second mortgage is an adjustable rate.

If your lenders DTI limit is 28 for front-end DTI and 36 for back-end DTI you have a good chance of qualifying for a mortgage. Process for deeds of trust that include a power-of-sale clause and a. Is a diversified community-based financial services company.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted. This mortgage type always carries a high-interest rate and they are usually offered to first-time home buyers with little to no cash in hand. Use SmartAssets free California mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more.

A mortgage calculator can show you the impact of different rates on your. Typically lenders cap the mortgage at 28 percent of your monthly income. Wells Fargo Co.

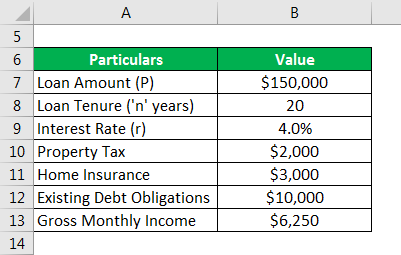

In this example if you apply for a mortgage with your spouse your front-end DTI ratio will be 2053 and your back-end DTI ratio will be 3417. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Calculating GDS TDS.

Factors that impact affordability. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Which is another type of mortgage document your lender can invoke the power of sale.

Calculate loan payment payoff time balloon interest rate even negative amortizations. Insured Mortgage Purchase Program IMPP COVID-19. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for your maximum monthly mortgage payment.

Brets mortgageloan amortization schedule calculator. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf.

While your personal savings goals or spending habits can impact your. Get 175 cashback when you switch your current account to us. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and student.

Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early. Our mortgage calculator helps you estimate your monthly mortgage payments. Fridge Stove Dishwasher Washer Dryer.

Contact mortgage loan insurance. Extras Appliances Included. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Some loan programs place more emphasis on the back-end ratio than the front-end ratio. Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. When it comes to calculating affordability your income debts and down payment are primary factors.

Home affordability estimate and monthly payment are based on a 30-year fixed-rate mortgage on a single-family residence with an interest rate of interestRate apr on aprDate for a borrower with excellent credit and. An estimated 61 of homes for sale during the four weeks leading to June 19. Most Of The Furniture Is For Sale As Well.

A piggyback can be a first mortgage for 80 of the homes value and a second mortgage for 5 to 20 of value depending upon how much the borrower puts down as a payment. Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. Todays national mortgage rate trends.

However an increasingly common option is the 15 year balloon. Wells Fargo Co. Available when you switch to a selected current account using the Current Account Switch Service pay in 1000 set up 2 Direct Debits and log on to Online or Mobile.

They can turn around to pay off the ARM with the proceeds from the home sale. And since your DTI is low youre entitled to a more favorable. As a result average mortgage payments exceed the 28 rule.

Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. It is engaged in the provision of banking insurance investments mortgage products and services.

Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates. Many financial advisors have suggested adhering to the 2836 rule which says to not spend more than 28 of your gross monthly income on housing expenses and only 36 of your income on. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

Multi-unit mortgage loan insurance. View listing photos review sales history and use our detailed real estate filters to find the perfect place. But for buildings with significant wear and tear or properties over 30 years old they may only grant a commercial loan for 20 years.

NHA Mortgage Backed Securities. 314718 73 of typical US. CECRA for small businesses has ended.

A commercial mortgage is referred to as a permanent loan when you secure your first mortgage on a commercial property.

Pin On T I P S I D E A S

Investment Website Templates From Templatemonster

0 Old Highway 50a Tract 3 Columbia Tn Mls 2429623

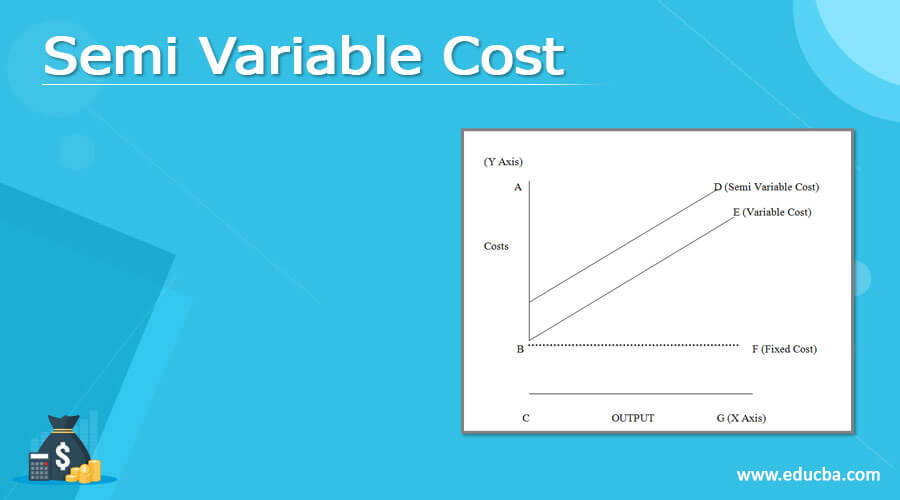

Semi Variable Cost Examples And Graph Of Semi Variable Cost

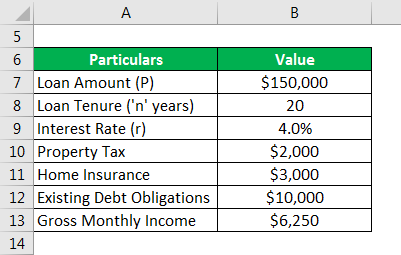

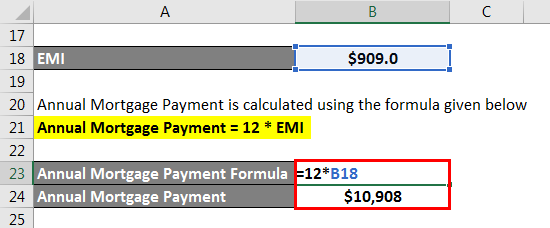

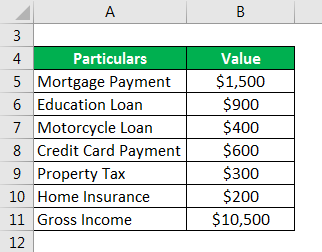

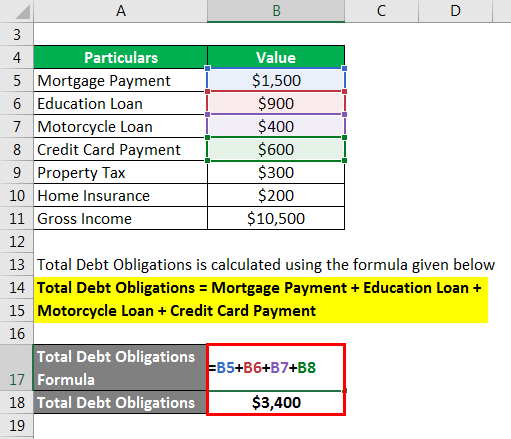

Total Debt Service Ratio Explanation And Examples With Excel Template

Hardship Letter Template 28 Lettering Letter Templates Business Letter Template

Total Debt Service Ratio Explanation And Examples With Excel Template

For Sale 10327 Starrs Road Arcadia Nova Scotia B0w1b0 202214274 Realtor Ca

House Design Saved By Sriram House Exterior Small House Elevation Design House Outer Design

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

For Sale Lot Arsenault Rd Dieppe New Brunswick E1a1y8 M142145 Realtor Ca

904 County Road 2600 Lometa Tx 76853

For Sale 77119 14w Road Woodlands Manitoba R0h0v0 202221090 Realtor Ca